02

Mar

The Ultimate Guide to Keeping Your Business Running Smoothly and Efficiently

A business of any category and size needs to run smoothly and securely at all times to be successful. Your particular business, most likely, will be your main source of income. If it is something you are starting from the ground up, you have to get familiar with the market’s current risks and opportunities. This is the only way you can create your success story. Any weakness in your cybersecurity, inefficient team effort, and poor financial decisions can all have a significant impact on your organization and its future success and growth.

Create a Digital Marketing Plan

Everything is digital these days, so it’s critical to stay on top of current and emerging trends. Digital marketing is one of the best ways to get your brand viewed at a much faster rate, as well as provide incredible chances through social media and email advertising. However, if you don’t have a solid strategy in place, you risk missing the wave and failing.

Spend some time figuring out how you want to be represented online. Engage your audience while also providing eye-catching material that is likely to be shared. Focus on the optimum times to post for the greatest reach. Many resources on the internet can assist with this.

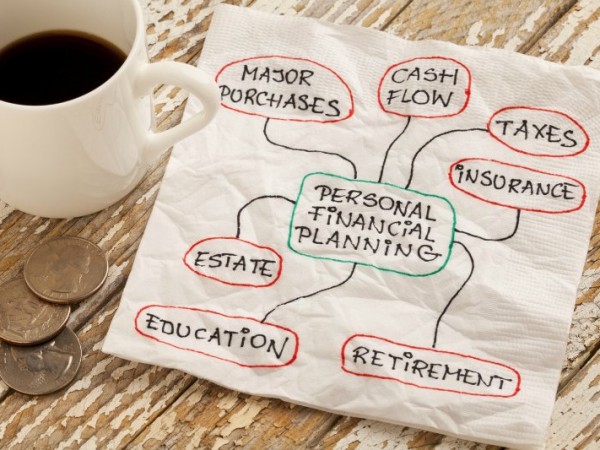

Keep an Eye on the Finances

At times, it can be hard to keep a check on the financial side of things. But if your business isn’t making money, then you need to ensure that you are making wise decisions when it comes to your budgets. Only spend when necessary and cut the costs of your overheads to keep you afloat.

When dealing with your financials, being accurate is the most important factor. One way to achieve this is to use a combo of mPOP cash drawer and receipt printer. This is a sleek, all-in-one solution to complete your countertop. Using the mPOP will automatically open the cash drawer or print receipts every time you complete a sale.

Build a Reliable Team

It sometimes takes a village to create and grow a business; even if you are doing it on your own, chances are you have a supportive partner or family cheering you on behind the scenes. It is critical to surround yourself with a good team of people that share your vision for the firm.

Surround yourself with trustworthy and like-minded people who will help you with making your ambitions a reality. Hire for trust and cultural fit rather than abilities. People can learn new skills, but someone who can’t be relied on to work hard or make sound decisions while the supervisor isn’t there is always a burden.

Ensure Cybersecurity at All Times

Employee cybersecurity training is now a requirement for all businesses. Too many users ignore fundamental security procedures such as using strong passwords, upgrading software, and failing to recognize a malicious email. We propose that you check out our helpful educational resources to help your personnel get up to speed on the finest Internet security practices.

To put things in perspective, approximately 41% of firm data leaks occur as a result of irresponsible or inexperienced personnel who fall victim to simple spam emails. Ensure that your servers are running an antivirus application. Running an antivirus program on your server is another smart security move.

Without one, you run the danger of an infection spreading from your file or terminal server to your endpoints. Antivirus on your servers also helps to restrict and reduce the damage caused by an infection that originates on one of your endpoints.

Examine Your Competitors

The best results are achieved by studying the market and your competition. As a businessman or businesswoman, you cannot allow yourself to be scared of your competition. Instead, you should spend time analysing and learning from your competitors if you want to be current with the market.

After all, they may be doing something profitable that you can replicate in your own business. Perhaps they’re making wiser investments so along with acquiring the mPOP cash drawer you could invest in another valuable equipment piece to keep you relevant.

Recognize the Risks and Benefits

Taking sensible risks to help your business expand is the key to success. “What’s the downside?” is an excellent question to ask. If you can answer this question, you are aware of the worst-case situation. This information will enable you to take prudent risks that can yield enormous returns.

Maintain Extensive Records

Every successful business keeps detailed records of everything they do, and so should you. In addition to keeping an eye on the budget with the reliable mPOP cash drawer and receipt printer, by keeping records this you’ll also be able to see where the company is financially and what potential challenges it may face as a result. Knowing this gives you time to provide solutions to overcome such obstacles. After all, learning from one’s mistakes is a crucial part of the process.

Be Prepared to Make Sacrifices

The road to opening and maintaining a business is difficult, but once you open your doors, your hard work will have only just begun. To be successful, you might need to put in more time than you would if you were working for someone else, which means spending less time with family and friends. But ultimately, this is the roadway to being a successful entrepreneur.

Provide Excellent Service

Many successful firms overlook the need of offering excellent customer service. If you provide superior service to your consumers, they will be more likely to return to you instead of turning to your rival the next time they need anything. Remember, customers are always right, so make sure you spend time asking for and analysing their feedback.

Concentrate on Your Long-Term Objectives

Finally, you must concentrate on your business vision and the brand that you develop. You must continue to acquire new business plans for your firm to continue trading and growing forward. Make the most of your brand’s one-time opportunity to make a positive first impression.

Maintain Consistency

Consistency is essential for making money in business. To be successful, you must continue to do what is necessary. This will help you develop long-term positive habits that will assist you increasing the income in the long run.

30

Jul

A Simple Guide to Sickness and Accident Insurance

For many hard-working Australians, spending time away from work due to an accident or sickness is simply not an option. Many people can’t afford to lose shifts and working hours, and in many cases, there’s no one else who knows how to run their business, so yes – involuntary days off are not an option. However, not many of them put much thought into their health insurance policy until something bad happens and they are left stranded without a stable income for a longer period. So suddenly, they find themselves in quite a predicament – either go to work sick or injured, or don’t go to work at all and lose money that they can’t afford to lose, and potentially, lose their job. For these reasons (and many more), it’s a wise idea to invest in a personal accident and sickness insurance policy.

Read More →

20

Mar

A Simple Guide to Motor Trade Insurance

Running a business is no small matter since it goes hand in hand with being exposed to many risks if you are not good at managing it. In the light of that fact, before starting, a business it is essential that you have a thorough plan that covers all the problems that should be avoided in future. In the motor trading business, you have to take all the necessary steps to make sure your business stays afloat. The most important aspect by far is the insurance. Trade motor insurance usually comes with several policies, all meant to protect businesses and individuals in the motor industry.

Read More →

28

Jun

SMSF Guide on How to Set up and Manage the Fund

Setting up an SMSF is not exactly a piece of cake, however, it is well worth the effort, considering all the benefits members are to get after the accumulation phase. Just like any other investment, there are certain rules that one needs to follow as to make sure there are nether risks nor complications that might prevent or delay the process. For the purpose of constructing a simple SMSF guide for you, below I’ve listed the things you need to know before starting your own fund.

19

Sep

How to Increase Your Chances of Getting a Self Employed Home Loan

Considering there are different kinds of people, there are different kinds of professions and interests to suit everyone’s wishes, but the really daring ones try their hand at creating their own business and rely only on themselves for their success. It might not always be that easy to run it no matter what the business is, because you get to be in charge of everything, holding the reins of every step climbing up the ladder but you mustn’t let that steer you away from trying your luck. Fear of failure is the primary obstacle to overcome since at first you’ll feel like it might not be a wise decision to make regarding the security of your future, however as it’s said “He who dares, wins”, you won’t see how well you are cut out for being a businessperson unless you rise above it. Read More →

03

Aug

Appointment Setting: Key to Generating New Business Opportunities

Every manager in the business world dreams of a large client list; whether it’s in law firms, trading, or even a computer company where employees barely have a face-to-face contact with potential clients – the struggle for more of them is real. Just look at the fuss that happened in the latest Suits episodes when Pearson Specter Litt lost all their clients, the development of the plot was one of two ways: either find new clients or file for bankruptcy. And choosing the easier way and digging your own grave is never an option. Which is why Donna was up for some serious appointment setting activity – the way the money is found and locked in your business.

You get my point – the more clients you have, the more money on your account at the beginning of the month. But to get to more clients, you need to convince them to be your clients first. Moreover, you first need to find them and convince them to give you a chance to talk. You know how it goes in the business world – time is money and no one has it in abundance, so you need to make a very convincing call to make an appointment. Read More →

25

Apr

Superannuation Investment Property Guide: Borrowing & Restrictions on Investments

When it comes to a superannuation investment property, there are a lot of rules and regulations that you must follow. First, you will need to hire professionals to help you set up a bare trust structure with a corporate trustee to be able to invest in a superannuation investment property. From that point on those who are involved in the self managed super fund can invest in commercial or residential property. It is important to note that neither the trustees or related parties are allowed to live in the property or use it occasionally. It must be used as an investment to benefit the super fund.

02

Apr

SMSF Guide For The Self-Employed

Setting up a self managed super fund (SMSF) is one of the most popular ways of saving money for the retirement. The distinction between this fund and the traditional way of saving money for retirement is the fact that you can use the assets you invest in this fund to receive income. One of the main advantages of setting SMSF is the control you have over the assets you invest. But, just like every other fund, there are certain rules that must be followed. For example, SMSF cannot have more than 5 members. Also, every member is at the same time a trustee of the fund as well. The fund is run for one purpose only – to benefit members and provide retirement income. Read More →

12

Feb

Simple Guide On How To Invest In Houses For Sale In America

Over the recent years, a large number of Australians have decided to invest in houses for sale in America. As a result of the global financial crisis that happened in 2007, the US real estate market has become very attractive destination for many investors from all around the world, including Australia.

Are you looking to buy a house in America? Don’t be surprised of the big number of houses for sale in America. The process of buying a home might be really exciting, but it is a long and exhausting process which requires a lot of time and patience. To find the perfect house for sale in America, read this simple guide to learn how to invest in houses for sale in America. Read More →